Your partner for insuring Swiss export transactions

Swiss Export Risk Insurance SERV supports Swiss companies with their export transactions. SERV:

- enables export transactions to be concluded with its insurance and guarantees,

- promotes the international competitiveness of the Swiss export industry,

- and helps to preserve and create jobs in Switzerland.

SERV services

From the production phase to the payment of the final instalment: SERV provides comprehensive insurance cover for the export of consumer goods, services and capital goods, covering the entire term of an export transaction.

Find out more about SERV’s services for exporters, financial institutions, project financing and major infrastructure projects.

SERV News

Here you can find the latest news and updates, as well as comprehensive background information about SERV – all at a glance.

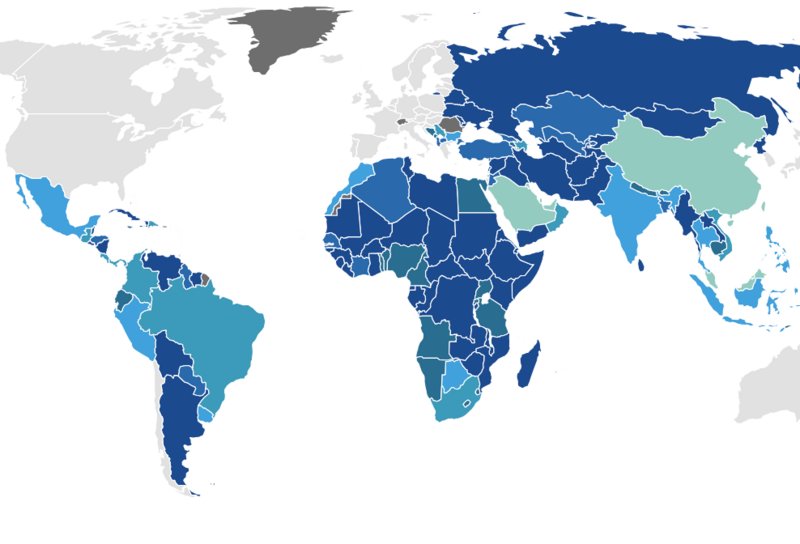

New country risk classifications from February 2026

The OECD Country Risk Experts Group has reassessed the following countries: Armenia, Moldova and Oman.

SERV is taking over responsibility for the Swiss Government’s GIP mandate

Overall responsibility for the Swiss Government’s major infrastructure projects (GIP) mandate was transferred from SECO to SERV at the start of 2026.

The new SERV customer portal

Our new customer portal has been online since 8 December 2025 – intuitive, well organised and transparent. Learn how you will be able to manage applications and projects, and discover the highlights in our video.

Interview with Barbara Hayoz to kick off the year

“It’s our responsibility to create stability – so that Swiss companies can act even in uncertain markets.”

SERV covers financing for waste processing plant in Great Britain

German bank KfW IPEX-Bank is providing corporate financing for a waste processing plant in Medworth (UK). SERV is securing the majority share of this financing for KfW IPEX-Bank.

Expedition Courage

Marc Hauser is the first man to dare to skydive into the jet stream. He explains what drives him and what courage means to him.

Initiation of partial revision of the SERV Act

On 29 October 2025, the Federal Council started the process for targeted further development of the SERV Act.

New country risk classifications from October 2025

The OECD Country Risk Experts Group has reassessed the following countries: El Salvador, Mauretania and Senegal.

Cristina Schulze-Bergmann to become the new director of SERV

SERV’s Board of Directors has elected Cristina Schulze-Bergmann as the new director of SERV. She will succeed Peter Gisler.

Stronger together: motorway project in Türkiye

Vira Tsymbalyuk (SERV) and Alexander Otten (Atradius DSB) told us about the successful cooperation between two export credit agencies on a motorway project in Istanbul.

Behind the scenes at SERV: risks and losses

What risks does SERV keep track of and what happens in the event of a claim? Claudia Oberle, Head of Claims and Recovery, and Meike Liatowitsch, Head of Legal, provide a glimpse into the nature of their everyday work.

Nakkaş–Başakşehir motorway project

Nakkaş–Başakşehir is the first BOT motorway project in Türkiye to be financed entirely in euro. Its 1.1 billion euro of project financing was provided by international banks and insured by ECAs.

Risk and portfolio management: credit analysis at SERV

Thorough risk assessment is essential, especially in uncertain times. Thomas Schudel, Head of Risk Analysis and Sustainability, offers some insights into the challenges of credit analysis.

New country risk classifications from July 2025

The OECD Country Risk Experts Group has reassessed the following countries: Bangladesh, Mongolia and Senegal.

International comparison of SERV: efficient but operating within a tight legal framework

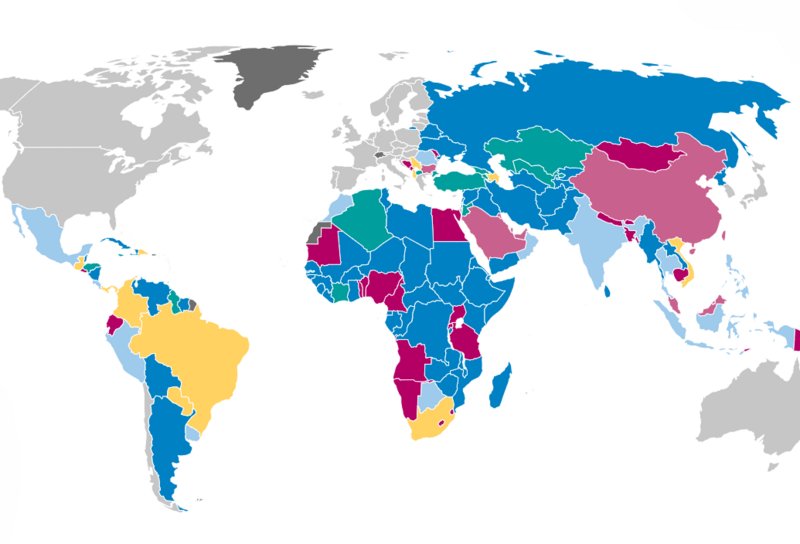

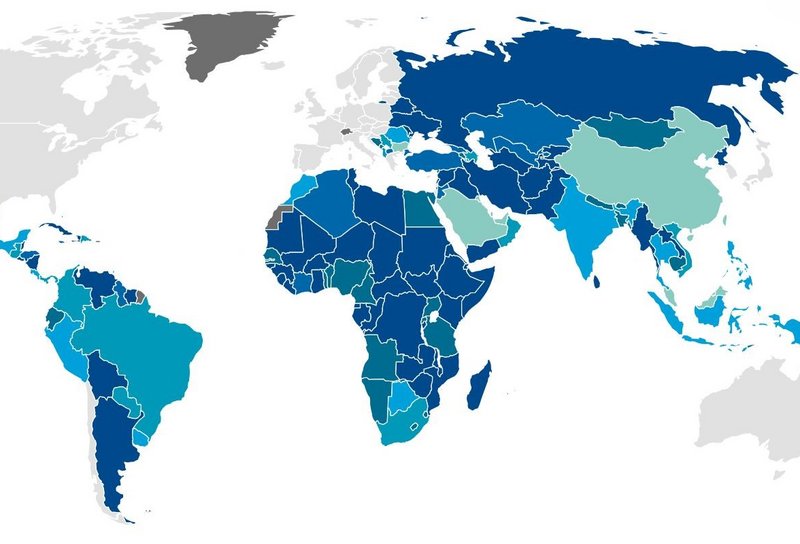

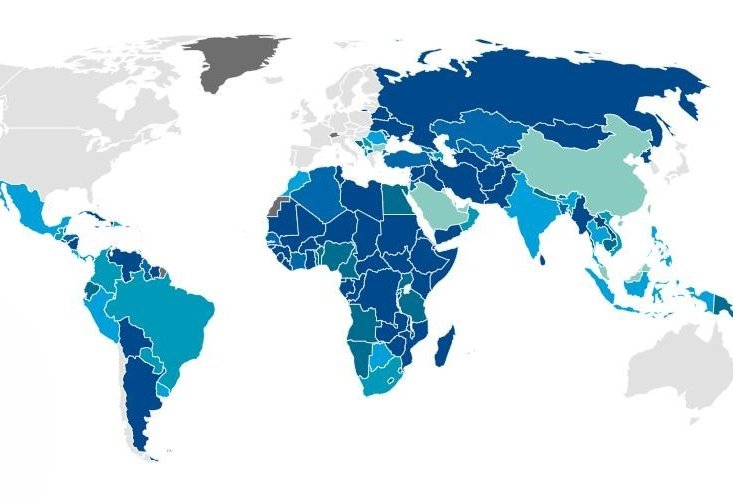

SERV had an international benchmarking study carried out. The study compared SERV with 17 other public export credit agencies (ECAs) on the basis of 20 indicators relating to a range of key areas.

Adjustment of cover policy for Senegal

The SERV Insurance Committee has redefined Senegal’s cover policy. The new cover policy defined by the Insurance Committee takes account of the ongoing strained financial situation.

Now you can start your secure export transaction even more quickly – with the SERV counter guarantee

Order processing is now a lot faster for counter guarantees under CHF 800 000. SERV can now issue the requisite cover commitment within five working days by means of a simplified risk assessment. This is contingent on having a complete and correctly submitted application. Markus Löbke, a risk analysis expert, explains how the risk analysis works.

How Swiss companies stay successful over the long term in challenging times

Following the COVID-19 pandemic, the war in Ukraine and climate transformation, the Swiss export industry now faces another challenge. Find out more about how companies can tap into new markets while the global economy enters a critical phase and the US loses reliability as an important trading partner.

SERV supports urban ropeway project in India

The Swiss company Bartholet Maschinenbau AG is building the first urban ropeway in Varanasi. In this interview, Andreas Oel provides fascinating insights into the challenges of the project and its successful implementation.

Annual Report 2024

SERV closes its 18th financial year with a pleasing net income of CHF 98.9 million.

How Swiss SMEs make the leap to global large projects

Find out how SERV paves the way for Swiss companies to bid for international projects.

How do you carry out a risk analysis for a film production?

Sina Guffarth is a risk analysis expert and corporate analyst at SERV. In this interview, we join her for a look behind the scenes.

Update on country risk classifications

The following countries have been reassessed by the OECD Country Risk Experts Group.

The risk-conscious route to success in elite sport: making it happen

Dominique Gisin explains what it takes to be successful in elite sport.

Risks are our job

Risks are our job: we have been assisting companies by covering a wide range of risks and supporting them throughout the entire duration of their export transactions for nine decades.

Update on country risk classifications

The following countries have been reassessed by the OECD Country Risk Experts Group.

Dealing with the Non-Marketable

SERV presents a whitepaper on how ECAs can assess illiquid risks of export finance insurance in a mathematically consistent and fair manner.

“We prefer to rely on human intelligence.”

Yvonne Pusch (CFO) on digital transformation and risk management at SERV.

Update on cover policy for Bangladesh

The new cover policy takes into account the continued heightened political uncertainty and the strained financial situation.

Textile industry in Benin: new factory promotes economic growth

In Benin, a pioneering project in the textile industry is taking shape: the construction of a textile factory designed to transform the economy and promote sustainable growth.

Morocco: a dynamic market for Swiss exporters

Morocco offers Swiss companies a wealth of attractive export opportunities in the areas of agriculture, water management and renewable energy. Exporters can capitalise on this potential despite the challenges.

Bangladesh at a crossroads

After the coup in Bangladesh, the political and economic future of the country is uncertain. The cover policy has therefore been reassessed.

Côte d’Ivoire: a robust and promising growth market

Côte d’Ivoire, the largest economy in West Africa, offers major opportunities for Swiss companies in the areas of infrastructure, healthcare and education. The business environment is becoming increasingly attractive, though it does still pose some challenges.

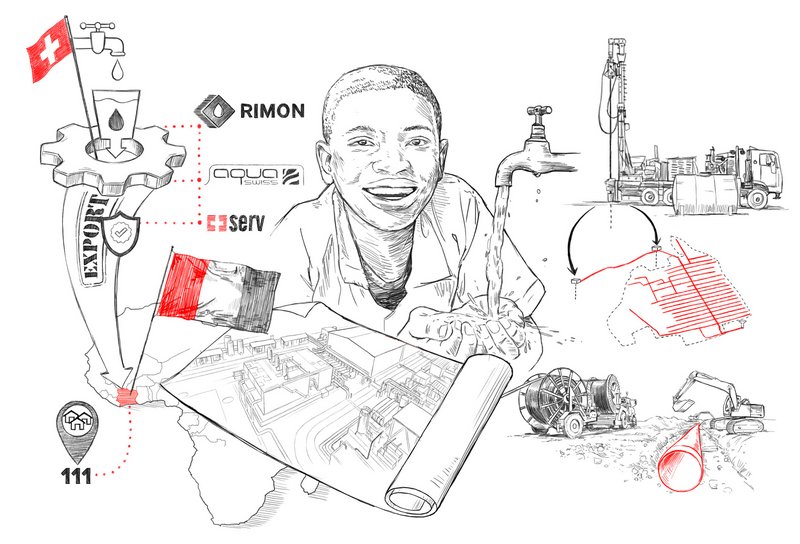

“Water for all” project in Côte d’Ivoire – SERV supports Swiss SMEs

SERV is supporting Swiss SMEs with the “Water for All” infrastructure project in Côte d’Ivoire. The aim of the project is to supply water to 6,000 communities.

Africa – a market of opportunities

The African economy is growing and still has great potential, particularly in infrastructure and energy. Swiss exporters can score points here with their expertise in specialised products. SERV is on hand as a guarantee partner for new business.

Adjustments to the GTC counter guarantee and the GTC contract bond insurance

SERV's GTC for the counter guarantee (GTC CG) and the GTC for contract bond insurance (GTC CB) have been adjusted slightly.

Update on country risk classifications

The following countries have been reassessed by the OECD Country Risk Experts Group.

Luca Albertoni has been elected as new member of the SERV Board of Directors

The Federal Council has elected Luca Albertoni as new member of the SERV Board of Directors.

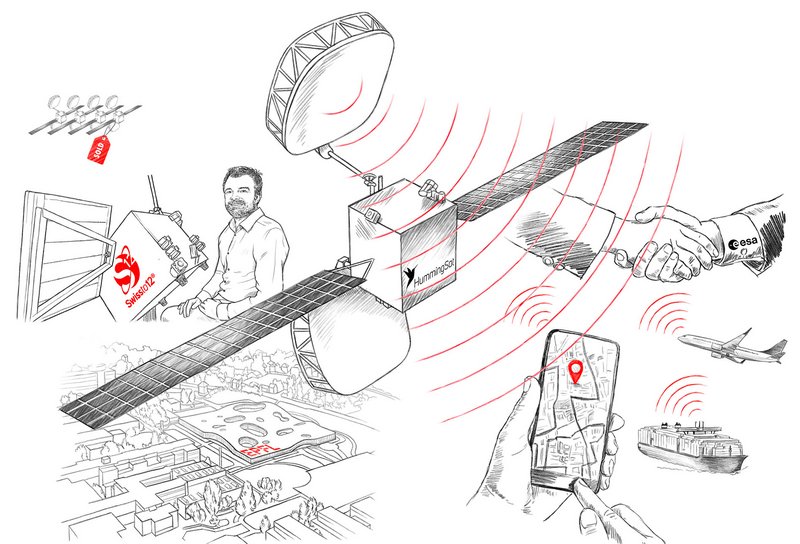

An innovation from Switzerland: satellites based on 3D printing technology

The working capital facility insured by SERV provides SWISSto12 with flexible growth capital to meet strong demand for its small GEO satellite HummingSat.

Opportunities and risks when entering new markets

There are many different challenges facing the Swiss export industry. In our interview with Brigitte Brüngger, we find out how companies can mitigate these challenges and successfully tap into new markets.

SERV’s Annual Report: solid financial year 2023

SERV is publishing its Annual Report 2023 today.

Strategic objectives of the Federal Council for SERV for the period 2024-2027

On 15 December 2023, the Federal Council approved the strategic objectives of Swiss Export Risk Insurance for the period 2024 - 2027. It maintains the organisation's current direction.

SERV is introducing the 2023 Regulations on Premium Calculation and a new policy concept today

The previously announced new 2023 Regulations on Premium Calculation come into force today.

New OECD Arrangement rules to apply from 15 July 2023

The new rules of the “Arrangement on Officially Supported Export Credits” (Arrangement) will come into force on 15 July 2023.

SERV to introduce new Regulations on Premium Calculation

In order to give Swiss exporters the best possible support and promote their international competitiveness, SERV relies on premium revenues.

SERV-insured deal wins TXF Award

On 15 June 2023, SERV, together with its partners, won the “Overall Best Export Finance Deal of the Year” award at the TXF Global Conference 2023 in Lisbon.

Team Switzerland Infrastructure – leveraging synergies for the Swiss export industry

The huge global need for infrastructure investments is creating a wealth of opportunities for Swiss exporters.

SERV creates and preserves up to 21,000 jobs in Switzerland

SERV conducted a study on the export and employment effects.

Modernisation of the Arrangement on Officially Supported Export Credits

The Participants to the Arrangement on Officially Supported Export Credits have agreed the mod-ernisation of the Arrangement.

Client Success Stories

Swiss Export Risk Insurance SERV supports and assists Swiss enterprises with everything from strategic direction through to the last payment for your export transaction. These success stories tell you how.

SERV events

SERV organises training sessions for customers on its products and services, as well as various events. SERV also participates in trade events such as trade fairs and exhibitions as a partner or with its own presentations.